We Featured on

17 Tagaytay Hotels with View Near Taal Lake and Volcano

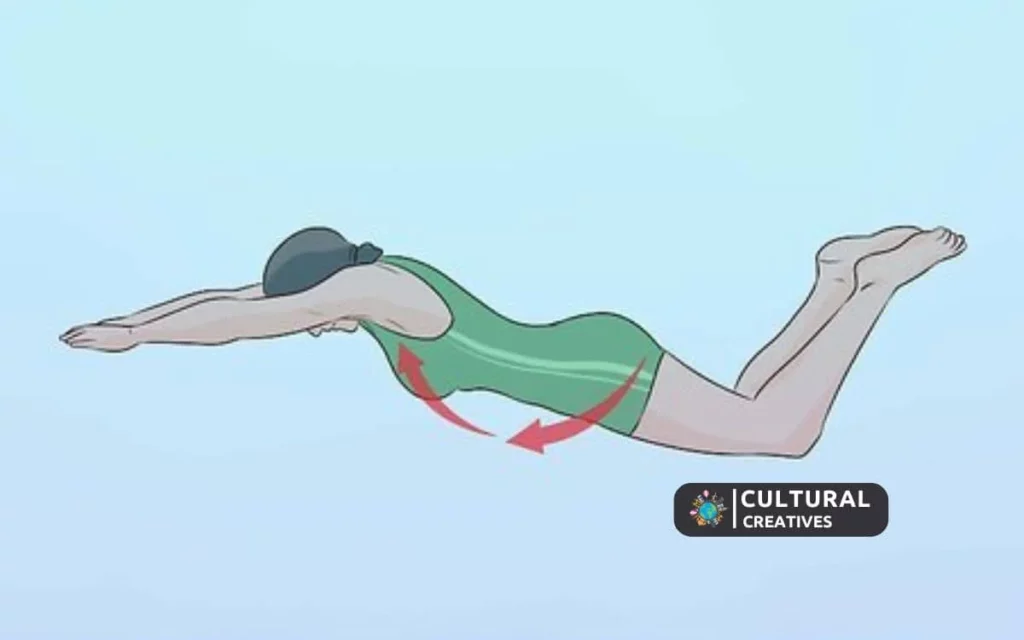

How to Swim Like a Mermaid Without a Tail?

ABOUT MELANIE HAIKEN

Melanie Haiken, founder of Cultural Creatives and an award-winning journalist based in Seattle, Washington, is a passionate world traveler known for her expertise in adventure travel, cultural immersion, and eco-tourism. Born and raised in Las Vegas, Nevada, Melanie’s early years instilled in her a deep appreciation for diverse cultures and natural beauty.

Her extensive travels across continents have led to in-depth travel guides and articles, inspiring others to explore the richness and diversity of the world. With a career marked by achievements in travel, science, health, and the environment, Melanie has contributed to prestigious publications such as Vogue Voyager and Earth Discoveries. Her positive and professional image, along with several awards, reflects her commitment to sharing captivating narratives that encourage global exploration.

More About Me

How to Get to Phi Phi Island from Phuket?

How Far is Wilmington from Myrtle Beach?